Alternative data represents information captured from any part of an organization, outside of traditional reporting metrics, that has implications for stakeholder decision making. Environmental, social, and governance (ESG) data are some of the most frequently cited forms of alternative data. Prominent organizations and investors race to meet the demands of increasing global pressure to prove the sustainability of their operations. Yet, they all continue to struggle with ESG data standardization, asset sourcing, and a noisy marketplace. With hundreds of data insights highlighting any number of different metrics and frameworks, investors can be left guessing as to which ESG-related questions they need to answer, what data insights provide them with the best answers, and where to source all of this data.[1] With so much uncertainty in an already ill-defined space, investors must know they can trust data to support decision making.

Deriving trusted insights from disparate data streams remains a major challenge for investors and operators alike. Traditional data sources only capture a small, narrow window into an organization’s financial, operational, or regulatory status. Alternative data broadens the scope of available information and provides deep insights for stakeholders who care about a variety of metrics. These alternative data streams can take many forms and come from any number of measurement sources. Satellite sensing, remote sensing, and human sampling represent just a few examples of the input sources that comprise the alternate data class. Stakeholders often struggle to sift through the noise of alternative data as they seek to gain more granular insights into their sustainability, resilience, and impact beyond traditional metrics.

Difficulties arrive from both ends of the spectrum. Oftentimes, stakeholders will know what types of insights they need to derive but have no idea where to get the data to feed their analyses. Inversely, decision makers may be inundated with noisy, seemingly disconnected data that they have to attempt to parse and process ad nauseum, sometimes never even finding the right insights to answer the use case.

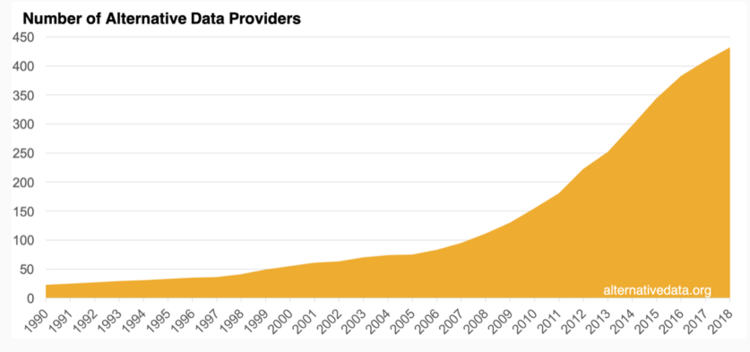

As a result of this increased need and desire for non-traditional data streams, the alternative data provider market has exploded in recent years. Fewer than one hundred firms provided alternative data a decade ago; that number has steadily risen to four hundred and forty-five providers according to a recent survey by AlternativeData.org.[2]

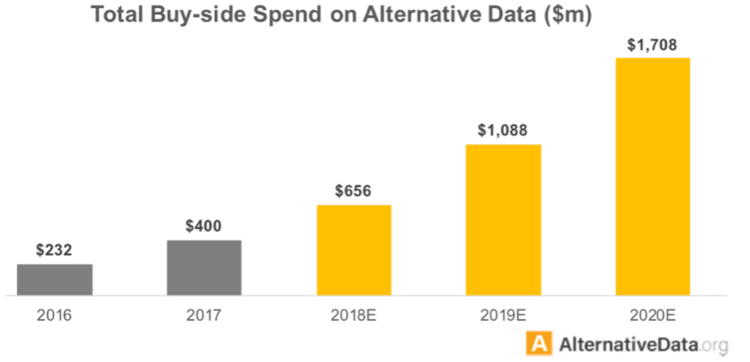

Spending on alternative data has ballooned exponentially as well. Recent estimates place the 2018 estimated investment community buy-side spend at $656M for 2018. With market factors continuing to push for the need to capture and synthesize this data, this trend shows no sign of slowing as estimates are nearly doubling each year to $1.09B in 2019 and $1.71B in 2020.[3]

With this level of investment, firms must be able to trust that this data has met the rigorous standard(s) investors expect out of traditional data sources such as financial statements, press releases, or SEC filings. These traditional data streams come from trusted and reliable sources with known audit processes and the ability to rectify and reconcile any differences. Without source provenance, investors open themselves up to major risks by relying on data without proof. Most sources of alternative data contain no proofing or consistency in measurements of variables.

The implications and uses of alternative data extend far beyond that of traditional investing and new data streams for investment evaluation decisions. Many other stakeholders or decision makers from numerous industries and environments trust alternative data to make critical decisions. Many of these decisions would not have even been possible in the last decade and some operators have struggled to keep up with the inputs.

Data of any source, traditional or alternative, needs to be raised to the grade of Asset Grade Data (AGD™). AGD™ is data that is so pedigreed, provenanced, proofed, auditable, and immutable that it becomes beyond reproach; any investor is comfortable trusting the insights derived from AGD™ to make significant financial, operational, or capital expenses based on it. A rigorous security approach and the right tools elevate that data to the level of an asset itself. Those derived insights, in turn, become Asset Grade Analytics (AGA). With billions of dollars in investment funds dedicated to sourcing these data streams, it is necessary to ensure they become assets.

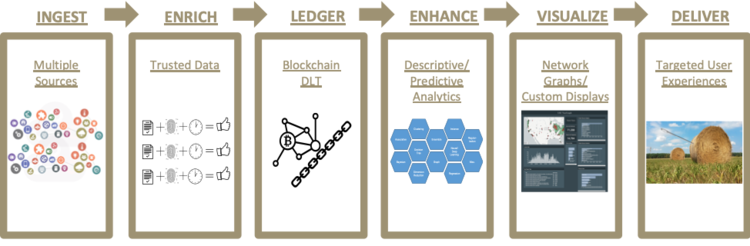

The Immutably™ product family from Context Labs (CXL) and Spherical | Analytics (S|A) provides investors with AGD™ through all-source data ingestion, unique cryptographic proofing methodologies, and private, distributed blockchain ledger technology. This transformation from raw, untrusted data into synthesized and consumable AGD™ allows for the formation of AGA with deep visualizations and derived analytic insights.

Alternative data may be classified as non-traditional information, but these types of data sources have increasingly been elevated to the forefront of a growing number of critical investing, operating, and governing decisions. Investors and operators have to quiet the data noise and glean those trusted insights. The Immutably™ product family from Context Labs and Spherical | Analytics accomplishes those goals with AGD, IGA, and trusted insights for nearly any use case or application.

Stay tuned over the coming weeks for Part 2: Ground Truth, where we will dive into the importance of Internet of Things (IoT) sensor-sourced data’s transformation into AGD, and Part 3: Trust in which we explore some emerging uses cases and applications of AGD using the Immutably™ family of products from CXL and S|A.

[1] https://www.ssga.com/investment-topics/environmental-social-governance/2019/03/esg-data-challenge.pdf

[2] https://alternativedata.org/alternative-data/

[3] https://alternativedata.org/alternative-data/