In the first two parts of our series on data provenance, we set out to define some key terms related to data and trust. Part 1 focused on Asset Grade Data (AGD), an entirely new class of trusted data that is so pedigreed, provenanced, proofed, auditable, and immutable that it becomes beyond reproach and is elevated to the level of an asset itself. Part 2 extended those principles and applied them to the concept of Ground Truth: point of origin instrumentation data with the highest possible levels of persisted pedigree, provenance, and security.

This third and final part will evidence the way Context Labs (CXL) and Spherical | Analytics (S|A) have applied those principles of AGD and Ground Truth towards different projects and programs.

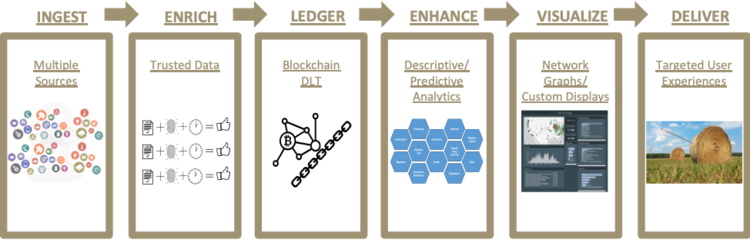

As a reminder, the Immutably™ product family from CXL and S|A provides investors with AGD through all-source data ingestion, unique cryptographic proofing methodologies, and private, distributed blockchain ledger technology. This transformation from raw, untrusted data into synthesized and consumable AGD allows for the formation of Asset Grade Analytics (AGA) with deep visualizations and derived analytic insights.

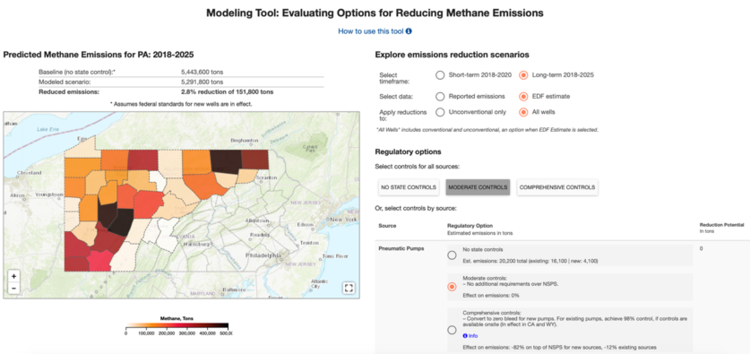

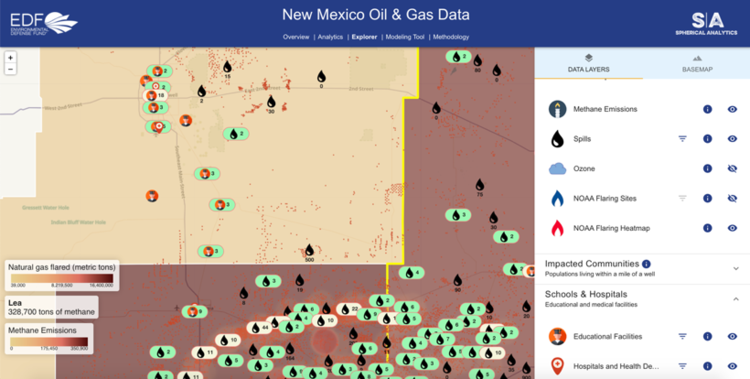

S|A has applied these principles to the frack gas and shale oil operations that occur within several of the major United States basins. Partnering with the Environmental Defense Fund, the Immutably™-powered Environmental Data Initiative has brought deep insights into extraction operations and their climate, financial, and population health impacts starting with Pennsylvania in 2018 and New Mexico in 2019. By analyzing methane emissions by site and source, S|A has transformed numerous data streams into AGD and derived IGA along with key metrics like production and emission amounts accounting, revenue dollars lost due to uncontrolled emissions, and impacts on proximate local communities. These deeper insights, in turn, allow: operators to gain a better understanding of their impacts, regulators to visualize the modeled impacts of different regulatory scenarios, communities to understand the volume of tax revenue losses, and local citizens to grasp the impact these emissions have on their communities and quality of life.

State, municipal, and regional governments and their infrastructure management partners are also increasing their reliance on alternative data to assess the baseline conditions of their existing infrastructure assets and operations. The global “infrastructure gap” capital requirement ranges from $20T to $40T. Public sector balance sheets are not positioned to provide the majority of this financing. Private capital markets will need to be tapped. Those private capital markets will need richer, higher resolution, higher frequency, and better trusted alternative data to properly assess traditional and emerging operational, cyber, and climate risk to these assets. Of course, lives are at stake, but so too are bond and risk ratings as even one-eighth of one percent increase in a community’s interest rate can have massive negative cash flow implications for already stressed city services and treasuries.

Securing that data has also never been more paramount in even small cities, such as New Bedford, MA, that have seen major cyber-attacks in recent years where hackers have attempted to exploit seemingly unprepared communities.[1] The city of New Bedford avoided spending millions of dollars in legal, insurance, security, consulting, and other expenses, but many communities will not be as lucky since bad actors will continue to learn from every attempt. Having a proofed and auditable trail of AGD ensures the provenance of that data throughout its lifecycle and secures it in case of an event such as this.

The network effects of baselining sustainable infrastructure operations extend beyond the implications for the city managers themselves. With the 2017 tax code updates, Opportunity Zones (OZs) were created to stimulate growth and investment in traditionally underserved communities by creating capital gains tax breaks for investors. These investors in turn have to meet a number of regulatory stipulations to be eligible for these tax incentives. S|A tackled this problem in Kansas City in partnership with Blueprint Local. The Immutably™-powered KC Targeted Investment Monitoring Platform sought to synthesize public and private data streams that focused on infrastructure, investment opportunities, business formation data, and socio-economic factors to give potential OZ investors confidence in their decisions to invest in new neighborhoods and local opportunities. AGD and AGA help ensure confidence in the accuracy of input data while also providing evidence of returns on investment.

As decision-making continues to trend in the direction of sustainability, evidencing the quality of one’s goods or operations becomes an important purchasing decision for consumers. Food traceability represents one of the most prominent examples of market demand for higher-quality, known-source goods. The aforementioned abundance of IoT sensors, in Part 2 of this series, has enabled growers both large and small to get granular resolution on the conditions of their harvest. The AGD that feeds insights can, in turn, be used to show the provenanced life cycle of that good. Buyers that have confidence in the state and status of their expected goods are willing to pay more, pay sooner, and provide repeat business. That level of trust between supplier and buyer can only happen with AGD and the insights derived from alternative data.

These principles of traceability extend into another important use case: maritime fisheries/aquaculture operations. The same standards that apply to growing operations in a greenhouse are just as relevant in aquaculture and farm-raised marine protein harvesting. With Ground Truth data, growers can evidence the conditions of their harvest throughout its lifecycle. Knowing the conditions in which one’s food was grown provides an irreplaceable sense of confidence for buyers. Buyers secure in the freshness of their shipments pay more and create repeat business. Consumers are also more likely to seek out sustainable or resilient options when given these choices and presented with evidence.

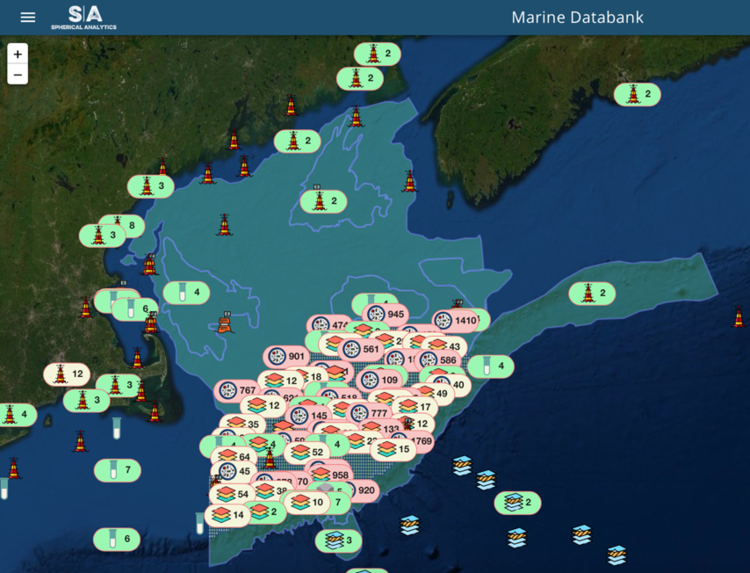

The management of wild fisheries requires AGD as well. In a time of rising sea levels, shifting water temperatures, and volatile conditions, it becomes ever more difficult for fishing fleets to successfully harvest in their traditional locations. With increased competition for a dwindling and finite resource, fleet managers must be as efficient as possible in their operations. Moreover, regulatory bodies face massive challenges in monitoring and maintaining those healthy fisheries to ensure wild stocks do not plummet and cause entire ecosystems and industries to fail in the process.

S|A is currently working with the Port of New Bedford – America’s largest commercial fishing port by revenue for nearly two decades – to pilot an Immutably™-powered platform that aggregates public and private AGD into a single Marine Databank.[2] By partnering with the New Bedford Port Authority, the University of Massachusetts-Dartmouth School of Marine Science and Technology (SMAST), and the fishing fleet, the project aims to secure fishing fleet data to layer over public data streams. In doing so, it will derive the finest-grained insights to help maximize sustainable catch, monitor the health of the George’s Bank fishery, and keep fleet owners’ data private and secure. This, in turn, can help enable a Databank-Exchange model where data verified as an asset can be shared, traded, or sold among private parties within the same distributed ledger. By creating these efficiencies, the city and industry can thrive, the academic and regulatory stakeholders can continue to monitor the harvest with increased granularity, and the fishing grounds can remain rich and thrive for generations to come.

The maritime implications of AGD also do not cease with wild and farm-caught protein sources. The offshore wind (OSW) industry has begun to boom along the Northeast coast with new leases and turbines approved and installed each year. These renewable energy sources have vast implications for the energy security of entire multi-state regions, resilience of host communities, health and wellness of the aforementioned fisheries operations, national-level economies, and even ocean’s health. By providing OSW operators with the same AGD and AGA, they can build the most accurate baseline assessments, most precise ongoing maintenance and operations monitoring, and provide deeper insight into key attributes of the impact of OSW on myriad stakeholder interests. By quantifying impacts on communities using AGD and AGA and sharing them appropriately, OSW operators can better engage every stakeholder group to enhance each resilient opportunity and mitigate any resilience risk.

Alternative data may be classified as non-traditional information, but these types of data sources have increasingly been elevated to the forefront of a growing number of critical investing, operating, and governing decisions. Investors and operators have to quiet the data noise and glean those trusted insights. The Immutably™ product family from Context Labs and Spherical | Analytics accomplishes those goals with Asset Grade Data, Asset Grade Analytics, and trusted insights for nearly any use case or application.

Stay tuned for more updates from CXL and S|A as we expand our applications of the Immutably™ platform to different use cases and develop our feature set and functions capability.

[1] https://www.npr.org/2019/09/06/758399814/town-avoids-paying-massive-5-million-ransom-in-cyberattack

[2] https://www.southcoasttoday.com/news/20181213/port-of-new-bedford-ranks-no-1-for-18th-consecutive-year